Since the Hamas offensive on October 7, 2023, the Israeli military operation in Gaza and its humanitarian consequences have brought the issue of trade sanctions against Israel to the forefront. As of July 2024, over 37,000 Palestinians have died as a result of the Israeli offensive. This number could rise to over 186,000, taking into account indirect deaths due to factors such as destroyed medical infrastructure and food and water shortages. 70% of homes in Gaza have been destroyed and 80% of the population has been displaced. In response, Turkey has suspended trade, and other countries, including Belgium, Canada, Italy, Japan, the Netherlands, and Spain, have decided to suspend arms trade. In Europe, the governments of Belgium, Ireland, and Spain have publicly advocated for the imposition of trade sanctions. The issue has also been raised by the European Union’s Foreign Affairs Committee.

Economic sanctions have become an important tool in modern foreign policy. As of 2023, the UN maintains 14 ongoing sanctions, while the United States has imposed more than 25 since the early 2000s. Research on the effectiveness of economic sanctions shows that they tend to be more effective when they impose significant economic costs on the target economy, are multilateral and led by international institutions, aim for moderate policy changes rather than ambitious goals, target allies rather than adversaries, and target democratic regimes.

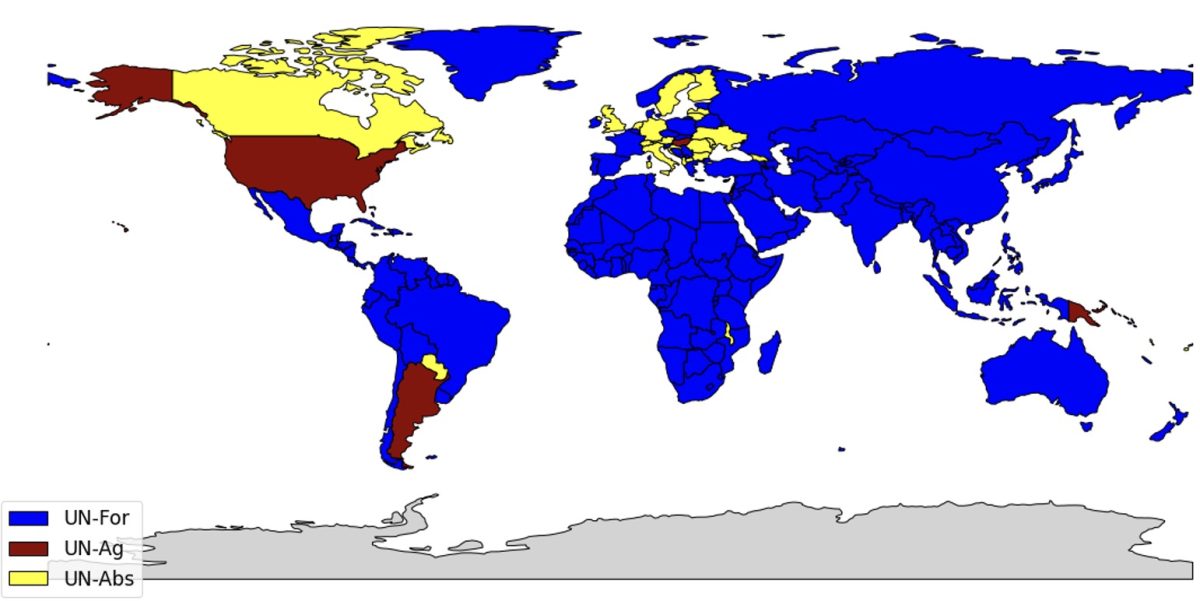

In this analysis, I use a multi-country, multi-sectoral trade model to examine the impact of tariff sanctions on Israel. The model is based on De Souza et al (2024), Caliendo and Parro (2015), and Ossa (2014). Firms in each country produce competitively traded goods in a variety of sectors that are used as factors of production, along with final consumption and labor and intermediate inputs. Trade is affected by iceberg costs and government-imposed import and export tariffs. I calibrate the model using the OECD Inter-country Input-Output Tables, a data set that describes the interdependencies among 45 economic sectors and 76 countries. I categorize countries into four groups based on their votes on the resolution on Palestine’s accession to the United Nations (A/ES-10/L.30/Rev.1). Israel, countries that voted against the resolution (abbreviated as “UN-Ag”, nine countries including the United States, Argentina, and Hungary), countries that voted in favor of the resolution (abbreviated as “UN-For”, 143 countries including China, France, and Japan), and countries that abstained (abbreviated as “UN-Abs”, 25 countries including the United Kingdom, Germany, Italy, and Canada). Figure 1 shows a map of countries by their various votes.

I assume that the country imposing sanctions is a member of the “UN-For” group. I acknowledge that this assumption involves a considerable degree of arbitrariness. The question of which countries are more likely to impose sanctions is beyond the scope of this analysis. Rather, the purpose here is to assess the effectiveness of such sanctions. I compare this group to other hypothetical sanctioned country coalitions: the European Union, the BRICS (Brazil, Russia, India, China, South Africa), and the United States. Finally, while I focus here on the economic consequences of import and export tariffs, economic sanctions can also be implemented through a variety of other means, including asset freezes, financial market sanctions, or entry restrictions on key government officials and corporate executives.

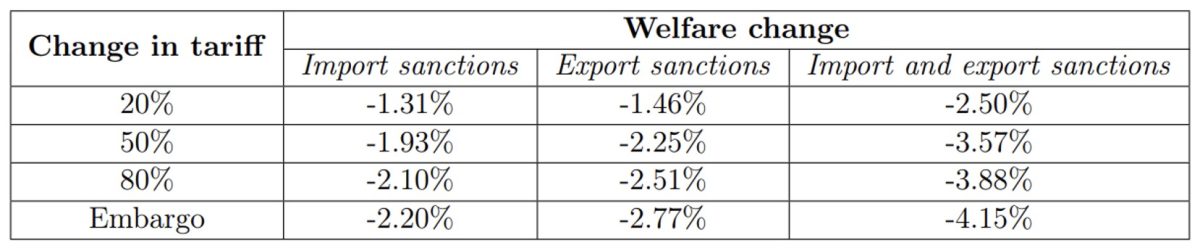

The results presented in Table 1 show that export tariffs have a slightly larger impact than import tariffs. A 20% change in import tariffs reduces Israel’s GNI by 1.31%, and up to 2.20% with an import ban. A 20% change in export tariffs reduces the reduction by 1.46%, and an export ban reduces it by 2.77%. Combining the two measures (import and export tariffs), the reduction ranges from 2.50% (20% tariff) to 4.15% (trade embargo). Finally, in all scenarios, the impact of sanctions (both sanctions and non-sanctions) on other countries is negligible, at around -0.02%. In other words, there is no economic trade-off with respect to tariff levels; it is a political choice.

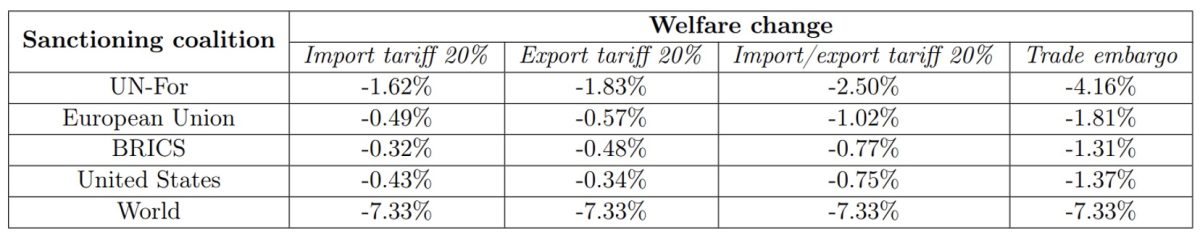

Table 2 compares the results for different coalitions of countries imposing sanctions. If the EU raises import and export tariffs by 20%, Israel’s GNI falls by 1.02%. If the BRICS raises the same amount, it falls by 0.77%, which is about the same as the US (0.75%). For comparison, the impact of trade sanctions on the EU is -1.81%, BRICS -1.31%, and the US -1.37%. At the extreme, if all countries in the world are involved in trade sanctions, the impact is -7.33%. This shows that the larger the coalition imposing sanctions, the greater the economic impact.

These values are within the range of Neuenkirch and Neumeier (2015), who estimate that the impact of “severe” UN sanctions, such as a complete embargo imposed by UN member states on the target country, will be between -5% and -6% on GDP growth. They are also consistent with the prediction of the Armington model that welfare gains from trade should be at least 1 − λ.-1/eHere, λ is import penetration minus 1, and ε is the trade elasticity. Since Israel’s import penetration is 17%, λ = 0.83, and the trade elasticity is about -5, implying that the welfare loss due to the embargo is at least 3.66%.

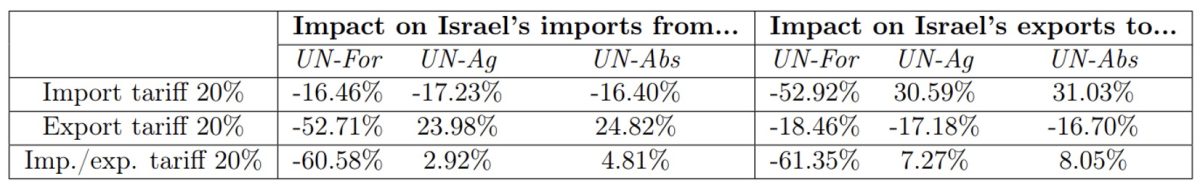

Table 3 shows the impact of sanctions on trade between Israel and other countries. If UN-For imposes a 20% import (or export) tariff, Israel’s exports to (or imports from) these countries will decrease by 52.92% (or 52.71%). This will be partially offset by an increase in Israel’s exports to (or imports from) non-sanctioned countries: exports to (or imports from) UN-Ag by 30.59%, exports to UN-Abs by 31.03% (or 23.98% from UN-Ag and 24.82% from UN-Abs).

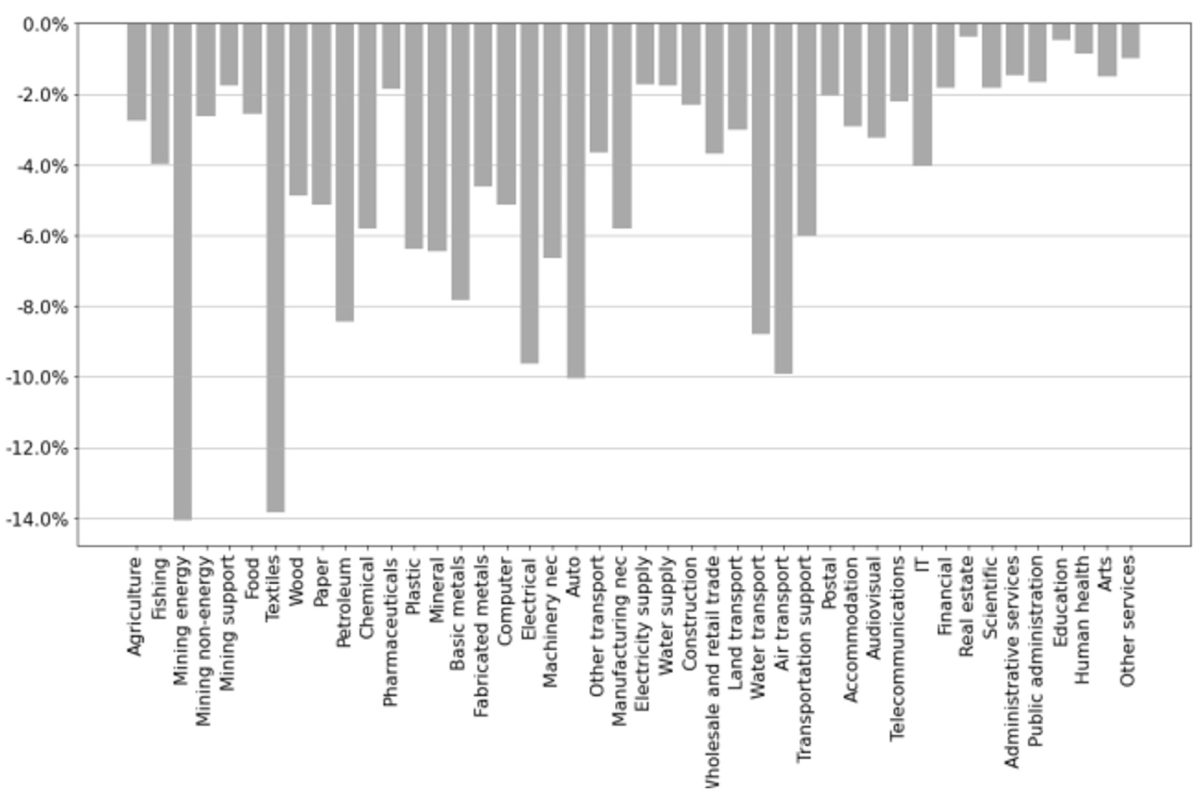

I now study a sectoral analysis of the impact of trade sanctions. I assume that the country imposing the sanctions raises import and export tariffs by 20% and that Israel does not impose counter-sanctions. I also assume that there are no sanctions on food and pharmaceuticals.

Figure 2 shows the change in purchasing power (PPW) in various sectors. It shows how much the amount of goods or services that can be purchased per unit of wages in each sector has changed as a result of the sanctions. The sectors with the largest decreases in PPW are fossil fuels (-14.07%) and textiles (-13.83%). Refined petroleum (-8.43%) is also noticeably affected by the impact on fossil fuels. Other sectors that show significant decreases include automobiles (-10.06%), air transport (-9.92%), and electrical equipment (-9.63%). The impact on essentials such as food (-2.58%), medicines (-1.85%), and electricity (-1.73%) is still moderate.

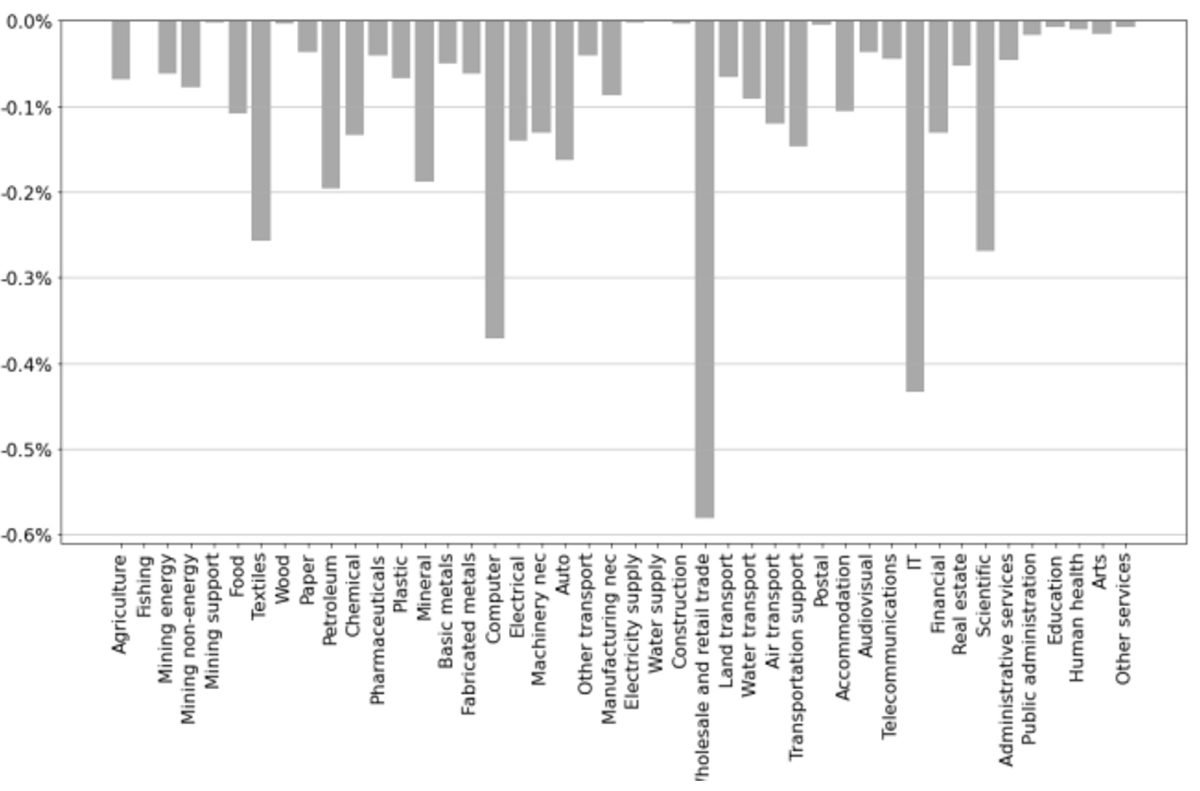

Finally, let’s look at which sectors are most effectively targeted by sectoral sanctions. Figure 3 shows the change in Israel’s GNI as a result of trade sanctions in each sector. The sectors most effectively targeted by sanctions are wholesale and retail trade, information technology (IT), computers, and scientific services. These last three sectors highlight Israel’s reliance on a high-tech economy. As of 2022, the high-tech sector accounted for 18.1% of Israel’s GDP, up 4 percentage points from 2012, making it the leading sector in the national economy. High-tech also accounted for 48.3% of Israel’s exports, a figure that has more than doubled over the past decade.

The results of this study suggest that tariff sanctions can have a significant impact on Israel’s gross national income. Sanctions appear to be more effective when they include a large number of sanctioned countries and target high-tech products and services.

Tables and Figures

Figure 1: Country map based on votes on the resolution (A/ES-10/L.30/Rev.1) to admit Palestine as a member of the United Nations.

Figure 2: Changes in wage purchasing power by sector.

Figure 3: GNI impact of trade bans by sector (by sector)

Table 1: Changes in Israel’s gross national income due to various tariff changes.

Note: Import sanctions correspond to increases in import tariffs from the Sanctions Coalition. Export sanctions correspond to increases in export tariffs from the Sanctions Coalition.

Table 2: Changes in Israel’s gross national income under different sanctions coalitions.

Table 3: The impact of tariff sanctions on Israel’s imports and exports.

Additional Resources on E-International Relations